More actions

ss |

m Asexualdinosaur moved page 2025 Financial Crisis to 2025 Financial crisis: Sentence case naming scheme |

||

(No difference)

| |||

Revision as of 11:52, 26 July 2025

Summary

During May and June of 2025, the DOC comandeered Vanguard National Bank, Discover Bank, Voyager Bank, and The Exchange following a liquidity crisis. The banking sector prior to the seizures was characterised by poor cash management, speculative investing, heavy interdependence of the banking industry, and security fraud.

Banking Seizures

Vanguard

On the 16th of May 2025, the DOC under Secretary xSyncx, seized Vanguard and Discover Bank - the two major banks under the leadership of Nexalin. The investigation into the

Tax Exemption Removal

Response

On 22/03/25, Nexalin (“Nex”) failed to submit financial reports to the DOC, leading to their tax exemption being removed. Nex initially tried to claim to his clients that he had submitted these reports when he had not filled out the fields.

After further prompting, he submitted all he was required and was returned his tax exemption on a few conditions:

- An audit of the banks by the DoC,

- Separation of Financial of Vanguard Group companies and proof that this has been done,

- Creation of separate LLC and / or corporations for each Vanguard Group Company as required including but not limited to Vanguard and Discover Banks,

- Any other proof needed to show that [the banks] are legally compliant with all regulations of a commercial bank registered in Redmont by law.

Nex acknowledged that non-cooperation will have the tax exemption removed and the bank potentially commandeered.

The Audit

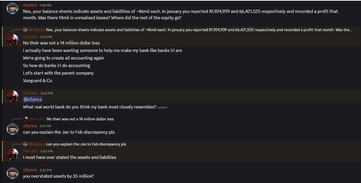

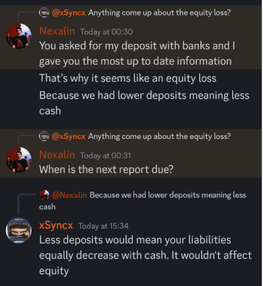

Equity Loss

Upon reviewing Nex’s financials, a loss of $14 Million in equity was clear. This was brought up by the DOC on the 28th of March but Nex tried to blame an administrative error before later backtracking saying "I must have over stated the assets and liabilities".

Nex then tried to explain away the loss in equity as a change in deposits (presumably withdrawals). This is not how equity works, and indicates either a poorly made-up excuse or a fundamental misunderstanding of recordkeeping.

As an example, saying “we had lower deposits, so less cash, so less equity” is wrong because deposits are liabilities, not equity.

Explanation: If someone deposits money to a bank, the bank now has more cash, yes—but they also owe that money back to the person, so their client obligations (deposits) equally increase. Conversely, if someone withdraws money, the bank has less cash as they pay out the client, and since it no longer owes this amount, their client obligations equally decrease . Equity is the excess value of what you own (assets) after subtracting all you owe (liabilities). Hence people depositing/withdrawing in exchange for cash has no immediate effect on equity. Blaming equity loss on “lower deposits” shows a misunderstanding of basic accounting.

2.b.ii. Liquidity Concerns

Furthermore, concerns about liquidity were outright dismissed by Nex. His enthusiasm to cooperate waned quickly once he had his tax exemption back. Pushing for further answers was delayed as we waited for the Warrant Fix Act.

Liquidity is a key concern for the DOC when monitoring the health of banks on DC. As many non-cash assets have volatile values (e.g Reveille property over the last six months) or not be easily tradable (e.g large sums of DC securities), it is incredibly important to hold enough cash to meet medium-term obligations to depositors. In other words, you need enough money to pay withdrawals without relying heavily on the sale of assets which may be difficult to sell quickly at a “fair” price, or even their listed book value (the recorded value on the financial statements). This effect becomes pronounced due to the concentration of wealth among DC players.

After these conversations with Nex, the DOC marked Vanguard as a risk to the financial system due to poor asset management and recordkeeping, particularly given the bank's size and industry-wide influence. We do not suspect malicious behaviour, rather managerial ineptitude.

Figure 6

Commerce Secretary xSyncx and Nexalin discuss concerns about Vanguard’s liquidity. Nexalin is informed that the DOC is confirming Vanguard’s cash reserves.

2.b.iii. Unrealised Gains as Income

It is also worth noting that Nex was, until prompted not to in April, listing unrealised security gains as income on his statements (from VMA and the Exchange). Removing this income revealed that Vanguard was in fact haemorrhaging money, particularly cash.

Abuses of VMA and its FX system seem to be at fault, which may have been avoided with better internal risk management. For example, VMA launched with many bugs, some of which remain unpatched, without a ToS that prohibited exploits. Many exploited the system, one of the most notable being an individual who traded outside of trading hours and generated over $3 Million. Their lawyers managed to settle the case and were able to withdraw the balance for cash. Repeat for other VMA cases and inefficient FX rates and the story of how the two banks haemorrhage money becomes clear. In-game cash holdings that were $10-15 Million a few months ago show barely $2 Million today.

Figure 7

Nexalin includes unrealized security gains as income on his statements.

Figure 8

Nexalin fails to elaborate, or remain communicative, on where the unrealised gains lie.

2. Foreign Cash Supporting DC Deposits

2.a. Cash & Cash Equivalents

Nex separates “Cash due from Bank” as a line item, leaving cash as the main asset under “Cash and Cash Equivalents” (No gov t-bills or commercial paper present in DC markets at the time of report). This account has incorporated foreign cash holdings held by Nexalin, despite being incapable of supporting client obligations in the event of withdrawal, nor is it recognized as an asset within Redmont.

Figure 9

Nexalin shows FRB Governor DonTrillions $2,130,580.80 of in-game cash after claiming a total of $31,655,825.41 of “Cash and Cash Equivalents”.

Nexalin only holds $2,210,280.80 at time of seizure, more than an order of magnitude below his claim of $32,549,263 just a few weeks ago. Nexalin listed these foreign currencies in $R ($DC) at an exchange rate of his choosing despite;

- a lack of frequent price discovery in inter-server FX

- any large conversions would likely shove the FX rate out of Vanguard’s favor.

- minecraft economies not being stable and major events could severely devalue these ‘foreign’ holdings

It appears the rate chosen for recordkeeping was the rate Vanguard facilitates client exchanges at (which for context, valued CRP’s starting balance as R$20,000. This was a popular exchange to make).

What was a ~60% reserve ratio, is closer to 3.6% when restricted to Redmont assets, which is where the vast majority of where the banks’ deposits are ($52M of $66M, the latter incl. Nex/Vanguard accounts). To have 78.8% of your deposits in Redmont but 93% of your cash on other servers is unbelievably dangerous for depositors. There is no guarantee that this cash could be easily converted at the listed FX rate, leading to many deposit obligations being impossible to meet in the long-term. This concern is ultimately why the bank was seized, alongside non-cooperation from Nexalin in regards to the conditions of the initial tax exemption return.

3. Records

Entry Name: April Balance Sheets of Vanguard Private Bank & Discover Bank, Record Starts 07/05/2025

Entry Name: April Income Statements of Vanguard Private Bank & Discover Bank, Record Starts 07/05/2025